Welcome, please enter your details below.

26 Jun 2016

Financial advisers utilise their most trusted communication channel “employee email”

Financial advisers utilise their most trusted communication channel “employee email” to leverage brand, improve cross sell opportunity and increase sales conversion.

Every day I am sure you see countless examples of employee emails that reflect poorly on the company’s brand and messaging. Often email presentation is technically incorrect – for example the signature block and disclaimers are all over the place. Apart from the brand ‘policing’ issue for marketers and IT administrators, there is the missed marketing opportunity that your employee email could be doing for the business. What a waste!

We have found the financial and insurance services industries in particular are embracing the use of Cumulo9 Mailprimer emails to address the core points above – especially breaking down customer silos by cross promoting other areas of business. At the same time, they are improving brand perception of their company – and improving the brand and profile of their representatives (e.g. brokers).

Unique solutions for Brokers and Advisors

Cumulo9 has been working with many financial services, from banks, broker groups and smaller insurance and advisory practices to improve business opportunities.

Our work with these companies has led to a suite of integrated Cumulo9 products designed to increase brand (and therefore company) value and drive customer engagement. This is ultimately expressed through higher sales conversion, reduced compliance risk, customer loyalty and improved operating margin.

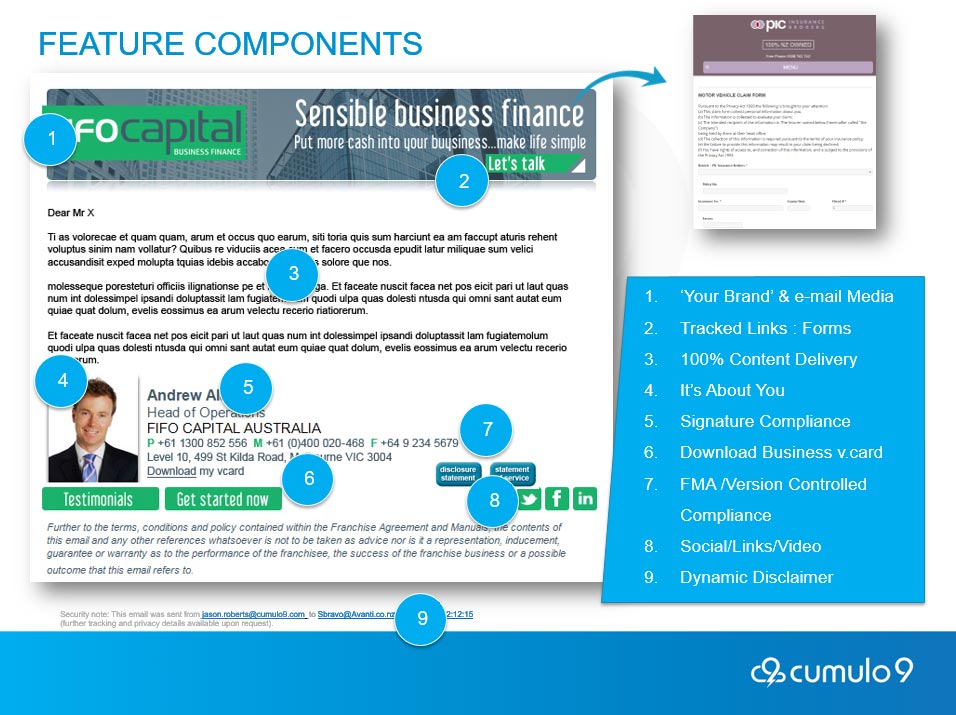

Here is a snapshot of the Cumulo9 solutions most companies initially consider:

Branded, tracked, and compliant employee email (Mailprimer One-to-One):

Virtually all companies want to leverage the look and feel of their outbound emails to increase brand equity, while ultimately generating cross-sell opportunities stimulated by embedded click through links. Email media banner messages and visuals inform our client’s customer base of unique offers, products and services prompting investigation in the mind of the recipient.

This provides a competitive advantage, as typically companies will have ‘silos’ of customer engagement and this simply represents lost opportunity from your established customer(s).

ROI:

As opposed to ‘pay per click’ advertising on websites, email media takes clients to a particular web page, sign up for, promotion etc. for a fraction of the cost. D2C Financial institutions typically have click-through rates of between 3 and 7% whilst high value, direct adviser/broker/wealth advisers can generate up to 15% conversion.

Personal brand:

We have also found that virtually all BDM’s will use their employee email to expand their personal profile (or brand) leveraging both personalised photos and /or links to social media. This functionality reaches into the heart of the core proposition: Trust.

Sales and prospect follow up – sales conversion

Using silent, real-time alerts the adviser has immediate insight into not only when a person opened their email (read alerts) but also receives notification of the images/banners and or links they may have clicked (click alerts). Armed with this information the adviser can not only decide when best to follow up with the prospect, but also increase the opportunity for an ‘upsell’ and/or ‘cross-sell’. Alternatively they may simply have assurance that their contract or disclosure statement has been reviewed.

Integration with CRM/financial services software:

Mailprimer One-to-One can be integrated with multiple CRM and financial services software packages.

This allows our clients to drive data, garnered via Mailprimer One-to-One e.g. click tracking, that can be shared back to the system where the client data lives. Products typically considered include: Salesforce, Microsoft Dynamics and IRESS (Xplan).

Minimising risk – compliance with Financial Markets Authority

In New Zealand, authorised financial advisers (AFA’s) need to correctly represent themselves and to provide proof of delivery of compliance documents such as disclosure documents. Mailprimer One-to-One uses version-controlled templates, embedded in outbound employee emails that automate the correct delivery of templates for compliance purposes and allow the links to separately serve landing pages that are delivered to unique URL’s. All links are tracked providing a transparent record of any recipient opening a disclosure statement which can be reviewed by the sender (the adviser), the company administrator and if needed by the regulator. The outcome is reduced compliance and brand risk.

In summary:

For Advisers: Leverage Company and personal brand. Track opening for assurance and prospect follow up.

For Marketers: manage and control signatures, messaging and with reporting, have real insight on customer response and activity.

For Business Owners/compliance: Complete confidence that messaging and documents are correct and verifiable.

For Administrators and IT: use the back end administrators’ system to set up, manage all users, control templates, designs and troubleshoot all emails with full reporting.